Real estate investment trusts are considered a great form of investment for many reasons. These includes lower risk and high returns potential. Also, other benefits like transparency, liquidity, and diversification… make it a perfect addition to any investment portfolio.

In other words, REITs are an ideal investment if you want to diversify your portfolio. Not only that, REITs generate an attractive income with a low-rate risk. That’s because they tend to be less risky and more stable than other forms of investments.

That said, REITs themselves aren’t one thing!

In fact, there are many different types of real estate investment trusts and they offer different types of great jobs.

And, to succeed as an investor, you should understand each type & learn how it works and differs.

Accordingly, in this article, we’ll introduce the 5 types of REITs and help you understand how each one works.

Here are the 5 types of REITs

Retail REITs

This type focuses mainly on owning and renting retail real estate assets. It usually includes shopping malls, grocery-anchored shopping centers, and other freestanding properties.

Speaking of freestanding properties, they’re rented to tenants who must cover their rent and operating expenses.

So, if you want to rent a freestanding property from a REIT, you must pay the rent… while simultaneously covering all the operating expenses.

In America, retail REITs are considered the most common type of investment. This means that your favorite shopping mall is properly owned by a REIT.

In truth, If you live in the U.S, you’re possibly investing in retail REITs… Even if you’re not aware of it.

As a matter of fact, you might own investments in this type of REITs thanks to your 401k or TSP. This makes retail REITs a great option for your retirement plans.

How to invest in retail REITs

Before investing in retail REITs, you should, first, study the retail industry and its economic condition. Ask yourself if the retail industry is stable at the moment.

And try to predict how it will be in the future. This evaluation is essential to decide whether the investment is worthy or not.

After all, REITs generate income through rent payments from retailers. However, if tenants couldn’t pay their rent due to poor sales, it will affect your ROI drastically. This makes it a bad investment for you.

So, as an investor, you should invest in strong retailers with a steady cash flow. Ideally, you should opt for grocery and home improvement stores.

After you examine the retail industry and find the strongest retailers, it is time to look for the ideal REIT company.

This means you should find a company with steady profits and as little debt as possible. In other words, you should work with a company that ensures a high return on investment with low risks.

Residential REITs

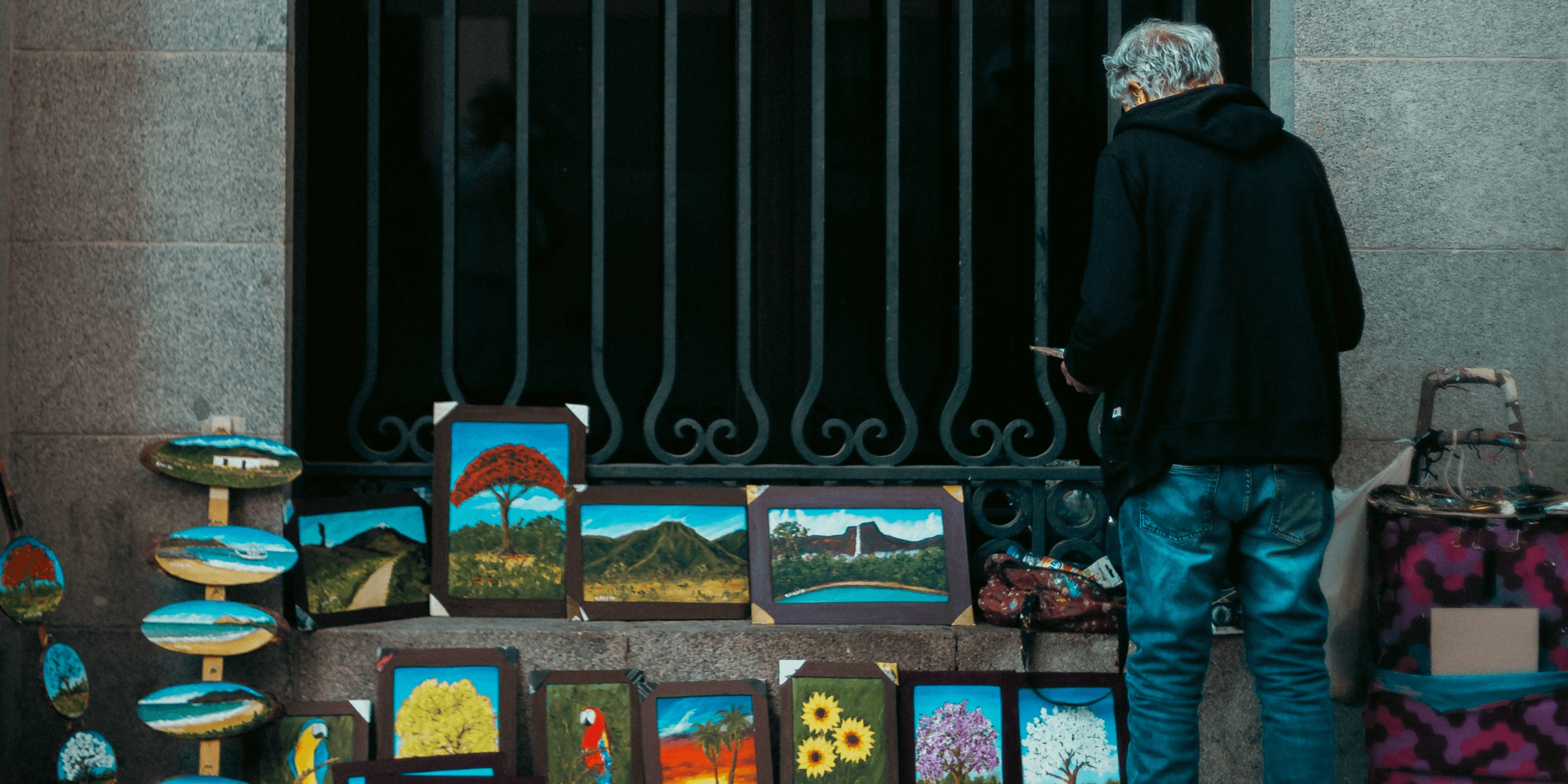

In a nutshell, this type of REIT owns and manages residential properties. Mainly, it focuses on apartment buildings, manufactured houses, single-family homes…, etc.

Residential REITs generate income by either selling or renting space and housing properties to tenants. Moreover, they operate within specific markets and deal with a particular class of residential properties.

How to invest in residential REITs

Markets with low house affordability tend to be the best to invest in. That’s because when the price of single homes is high, most tenants are forced to rent properties.

This allows property owners to increase the monthly payments tenants pay for rent… thus, promoting an increase in profits.

Moreover, when investing in residential REITs, always look for places with a high population & employment.

That’s because people are more likely to rent where there is a booming economy & job opportunities are high. Thus, it increases the demand for renting & buying housing properties.

Healthcare REITs

Healthcare REITs specialize in medical-related real estate properties such as hospitals, medical centers, retirement homes…, etc. As a result, succeeding in this type of REIT is entirely related to the healthcare industry.

However, what makes this subsector interesting is the fact that healthcare costs keep rising in the U.S. So, as the costs increase, the value and profits of healthcare REITs also increase.

What to look for when investing in healthcare REITs

Look for investments in a variety of property types as well as a diverse collection of clients. Spreading your risk is better than concentrating your investment in one place.

You should also look for companies with substantial healthcare experience, stable balance sheets, and lots of access to low-cost capital.

Office REITs

Office REITs sell and rent office real estate properties only. This includes skyscrapers, office parks, office buildings…, etc.

Usually, office real estate investment trusts operate within a specific market, like business districts & suburban areas.

Similarly, this type of REIT also focuses on a specific class of clients like government agencies and firms.

Once you decide to invest in this type of REIT, you should ask yourself the following questions:

- What are the economic conditions and the unemployment rate?

- How high are vacancy rates?

- How is the economy in the region where the REIT invests?

- How much capital does it have available for purchases?

Answering the above questions will help you assess the economical situation of your target market. It will also help you measure risk percentage VS the ROI potential while finding the best companies to work with.

Mortgage REITs

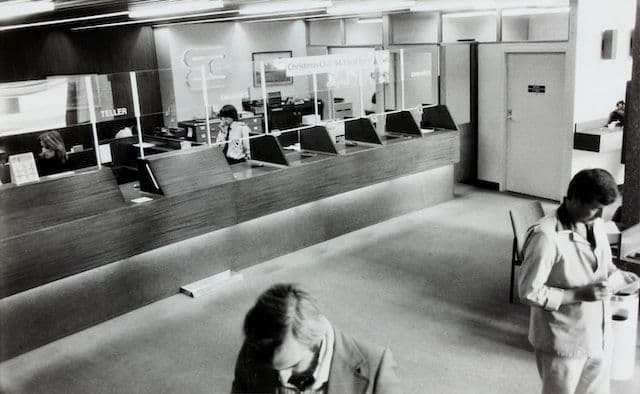

Mortgage REITs aid in supplying the real estate market with crucial liquidity. Mortgage-backed securities (RMBS), commercial mortgage-backed securities (CMBS), and residential mortgage-backed securities (RMBS) are all investments made by mREITs.

While some mortgage REITs participate in both RMBS and CMBS, most concentrate on the residential or commercial mortgage markets.

Similar to purchasing any publicly traded stock, you can purchase shares in a mortgage REIT listed on significant stock exchanges. Additionally, shares can be bought through a mutual fund or exchange-traded fund (ETF).

Because of their history of paying out relatively substantial dividends, investors have historically seen value in mortgage REITs.

Final thoughts

Although they are different types of REITs, they all have something in common. For instance, all REITs have a high potential for returns on investment with a very low-rate risk. This alone makes investing in REITs an ideal choice for investors.

Written by

I am the CEO and founder of Overmentality. I am a professional business and technical blogs writer and on-page SEO specialist. I hold a degree in Culture Studies and Media Literacy from the English Humanities and Art Department. And I am interested in Digital Marketing, Business, Entrepreneurship, Leadership, and pets of course!

You can reach me via email here: hamiidnouasria@gmail.com

Or find me on my LinkedIn Profile.