- What do we actually mean by a major bank?

- What types of jobs are available in major banks?

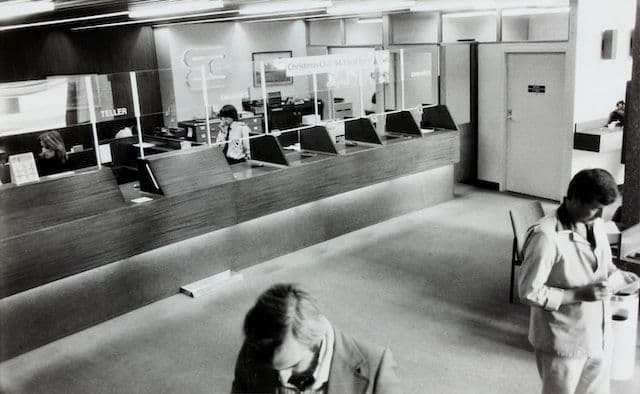

- 1. Bank teller: $36,310 per year

- 2. Loan processor: $41,370 per year

- 3. Banker: $48,136 per year

- 4. Mortgage consultant: $72,987 per year

- 5. Credit analyst: $59,704 per year

- 6. Investment representative: $47,342 per year

- 7. Investment banker: $85,618 per year

- 8. Financial advisor: $94,170 per year

- 9. Relationship manager: $66,701 per year

- 10. Financial analyst: $91,580 per year

- 11. Underwriter: $76,390 per year

- 12. Asset manager: $59,230 per year

- 13. Investment banking analyst: $91,580 per year

- 14. Internal auditors: $77,250 per year

- 15. Loan officer: $63,380 per year

- 16. Branch manager: $63,931 per year

- How many jobs are available in major banks?

- Conclusion

Major banks make up a large portion of the financial sector. Not only do the commercial banks in the US employ millions of workers, but they also contribute greatly to the country's economy.

In 2021, there were 4,237 Federal Deposit Insurance Corporation (FDIC) insured commercial banks in the United States. Amongst these is the 5th largest bank in the world by total assets, JPMorgan Chase.

JPMorgan Chase is currently in 5th place, which is preceded by four banks located in the People's Republic of China. The bank alone has more than 293,723 employees on their payroll.

According to Statista, the 4200+ other commercial banks in the US employed 1.95 million workers in 2021.

Unfortunately, if you're wondering how many jobs are available in major banks, we don't have good news. The number of jobs available in the future may be facing a downward spiral due to the rise of online and mobile banking apps that are automating operations formerly performed by human bank employees.

However, there's still hope because the industry is constantly growing and expanding. There are still thousands of bank positions and part-time jobs that you could apply for.

What do we actually mean by a major bank?

Major banks are institutions or organizations in the finance industry that offer deposits, credit cards, loans, and savings plans in their list of services.

These institutions can include Federal Reserve Banks, Regions Banks, and other financial trust companies that are organized under the law of the US.

It's a standard requirement that the institution has a capital and surplus worth more than $1 billion when combined to be considered a major bank.

The US has a group of 4 major banks that rank amongst the top banks in the world. The group is known as the Big Four banks, which include JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo.

With total asset data from Statista, we were able to compile the following list of the top 5 largest banks in the US:

1. JPMorgan Chase

With assets worth $3,665.743 billion, it's no wonder why this multinational bank is 4th largest in the world. Their headquarters are located in New York and they have more than 4,800 branches across the country.

2. Bank of America

This bank manages assets worth $2,407.9 billion. BoA is headquartered in North Carolina, but it was founded in California. Their payroll consists of 217,000 employees.

3. Citigroup

$1,714.47 billion of assets and 240,000 employees are just some of the statistics related to this group. Citibank is a multinational New York-based investment bank and financial services corporation.

4. Wells Fargo

Wells Fargo & Company operates in 35 countries, and they have more than 70 million customers across the world. With their headquarters in San Francisco, they manage assets worth $1,712.44 billion and employ 238,000 workers.

5. U.S. Bancorp

This $591.21 billion Minnesota-based American bank holding company has 3,106 branches with 78,192 employees working at them.

What types of jobs are available in major banks?

Not only should you be worried about how many jobs are available in major banks, but you should also take a look at the many types of jobs that you can pursue.

You have many options to choose from, which vary between local, state, and national bank positions. The options for jobs in commercial banks are almost endless.

Here is a list of jobs in the industry, with salary and outlook data from the US Bureau of Labor Statistics.

1. Bank teller: $36,310 per year

Your job description as a bank teller will include all the daily transactions that occur at the bank, like large amounts of money that need to be deposited and clients paying back their loans.

These duties are fairly straightforward, apart from the occasional difficult client. Therefore, you can walk straight into a bank teller position with a high school diploma.

As a bank teller, you could receive a median salary of $36,310 per year. The higher your qualifications and years of experience, the better your salary will be.

Now's the time to enter the market and secure a position because online and mobile banking will be stealing 12% of bank teller jobs from 2021 to 2031.

If you act fast, you could land one of the 35,200 jobs that will be opening due to workers leaving the workforce and changing careers.

2. Loan processor: $41,370 per year

As a loan processor, you will be required to conduct interviews with loan applicants and check their financial documents.

Your main duty is to assist the loan officer by performing tasks that will make their job easier. You need to get everything ready and hand the documents over to them, and they'll decide to approve or reject the loan application.

The minimum requirement to become a loan processor is a GED or high school diploma. You'll receive on-the-job training, but learning the necessary skills beforehand in a college course is beneficial.

The US BLS estimated that there were 208,800 loan processors in 2020. Unfortunately, this number is set to decrease to 203,800 by 2023. That's a projected job outlook of -2%.

If you land one of the available jobs, you can earn a median salary of $41,370 per year.

3. Banker: $48,136 per year

As a banker, you would work directly with a bank's clientele. With a vast knowledge of the bank's services, you'll need to answer questions and assist clients to use them.

Apart from communication and maths skills, you need a high school diploma. However, at least two years of working experience and a bachelor's degree will increase your chances of landing a good job.

You can receive an average annual salary of $48,136 in a regular banking position. More experience and higher qualifications can allow you to earn much more.

With a projected job growth of 6% between 2018 and 2028, there should be a position opening for you soon.

4. Mortgage consultant: $72,987 per year

If you choose to become a mortgage consultant, you'll be responsible for several tasks. You'll be consulting with financial loan institutions on behalf of clients who need a loan.

You can open your own practice and act as a commission-based mortgage consultant. The best way to get as many clients as possible is by developing a relationship with a local real estate agent.

With each client, you need to conduct an interview and collect all of their financial data. You will also need to explain the process to them and negotiate the best interest rates.

You can't work as a mortgage consultant in the US if you aren't licensed or certified. The process includes a bachelor's degree and at least 20 hours of coursework.

As a certified mortgage consultant, you can expect to earn an average of $72,987 per year.

Currently, there are almost 54,000 mortgage consultant job openings. This number is set to grow by 8% from 2018 to 2028.

5. Credit analyst: $59,704 per year

You can work as a credit analyst in various industries. If you choose to work as one at a major bank, you will be working with credit applications and potential loan applicants.

Your job will include analyzing the applicant's financial status and determining whether they will be able to afford to repay the loan amount with interest.

You need a bachelor's degree in any financial field and at least 4 years of experience working in numerous financial departments. Communication, mathematical, research, problem-solving, analytical, and computer skills are just a few of the skills that you will need to excel at this type of job.

Unfortunately, the job outlook isn't great for this career choice. With a 4% decrease in jobs from 2018 to 2028, you need to make the move to this career as soon as possible.

If you land one of the available jobs, you could be looking at an average salary of $59,704 per year.

6. Investment representative: $47,342 per year

Do you want to combine your interests and become a salesman in the financial industry? If you become an investment representative, you could be selling financial services and investment products.

You will also have the responsibility of liaising with clients and guiding them when they need help with their financial management. There are also many opportunities to work as an investment representative in Real estate investment trusts (REITs).

You need a bachelor's degree and a federal license to get started in this career. Communication, customer service, and sales skills will help you in your daily mission to sell annuities, stocks, insurance, estate planning, and trust funds.

There's a slight chance that you could land a job with a high school diploma but you probably won't be starting with the $47,342 average annual salary.

Investment representatives are one of the jobs in banks that will be needed in the future, with a projected growth of 4% from 2018 to 2028.

7. Investment banker: $85,618 per year

As an investment banker, you will be responsible for any investment and capital-related duties. These duties can include helping clients to raise capital, giving them advice on investment opportunities, and selling their stocks and bonds.

You will need a bachelor's degree and a license to become an investment banker. There are some necessary skills, like research, analytical, networking, communication, and interpersonal skills, that you will need to land a job.

You could be looking at an average salary of $85,618 per year, and even more if you have higher qualifications like a master's degree.

If you enter the investment banking job market, you will be working amongst 135,900 other workers. This number is set to grow by 9.6% between 2016 and 2026.

8. Financial advisor: $94,170 per year

Are you interested in advising clients on estate planning, investments, insurance, taxes, mortgages, and retirement funds? If you become a financial advisor, that's exactly what you will be doing.

If you intend to buy financial products, like stocks, annuities, and insurance, on behalf of your clients, you need to be registered with the US Securities and Exchange Commission (SEC).

All the skills and knowledge that you need can be obtained with a bachelor's or master's degree, which are the minimum requirements of personal financial advisor jobs.

The median annual wage for this career is $94,170. That's close to what you can expect to be earning if you land one of the new jobs that will be opening in the future. The projected growth for this industry is 15%.

9. Relationship manager: $66,701 per year

From meeting with clients to resolving their problems, you'll be working with clientele daily. You need to ensure that the relationships between companies, stakeholders, and clients are solid to boost sales.

You will be responsible for the company's communication system, and for this, you need a bachelor's degree and experience working in customer service.

The average salary of this career choice is $66,701 per year. If you intend on working yourself up towards becoming a senior relationship manager, you should know that the future outlook for this job is fantastic. From 2018 to 2028, there will be a job growth of 16%.

10. Financial analyst: $91,580 per year

You can choose to become a buy-side or sell-side financial analyst. In both cases, you will be working with stocks, investments, and bonds.

In addition to these two types, there are different types of financial analysts. These include financial risk analysts, fund managers, investment analysts, portfolio managers, rating analysts, and securities analysts.

The overall median salary for these types of analyst jobs is $91,580 per year. This is if you meet the minimum requirements, which include a bachelor's degree and a Financial Industry Regulatory Authority (FINRA) license.

Due to workers leaving the job force and getting promoted, there will be 32,000 financial analyst jobs opening each year from 2021 to 2031. During the same timeframe, there will be a 9% growth in this job.

11. Underwriter: $76,390 per year

As an underwriter, you can choose your own specialization. The typical fields are health, life, and property underwriters.

Your tasks will include assessing insurance applications to decide if they should be approved or declined. You will also be responsible for the premiums and coverage amounts that need to be determined after an application is approved.

A bachelor's degree and practical experience are just some of the requirements that you need to do this job. Most companies will offer a year's worth of training under senior underwriters before you get to go off on your own and handle your own applications.

You can earn an estimated median wage of $76,390 per year working as an underwriter. Unfortunately, the need for underwriters won't be as big in the future because the outlook is negative for this job.

There is a projected 4% decrease, but fortunately, there will be 8400 jobs opening each year due to workforce leavers.

12. Asset manager: $59,230 per year

If you have a high school diploma paired with problem-solving, customer service, organizational, and communication skills, you could become an asset manager.

Your daily tasks as a real estate asset manager will include financial planning and acquiring property. You will need to negotiate contracts and review the holdings of a company.

If you have a state license, you could easily walk into one of the 11,100 new jobs that will be opening between 2021 and 2031. The projected outlook for this job stands at a growth of 3% over the decade.

In this job, you could be earning a median salary of $59,230 per year.

13. Investment banking analyst: $91,580 per year

Your job as an investment banking analyst will include assessing the financial data of businesses. You will also be the person who answers any questions that a client may have about anything investment-related.

You will need to be licensed by FINRA and possess a bachelor's degree at minimum. For this, you could be looking at a median annual wage of $91,580.

The future outlook for this job is positive, with a projected growth of 9%.

14. Internal auditors: $77,250 per year

There are two types of auditors, namely internal and external auditors. These two careers have the same job description, which includes checking the management of the funds of an organization.

The only difference is that as an internal auditor, you would work for the organization and not an external party. You will be responsible for coming up with a strategy to eliminate fraud and financial risks.

You need a bachelor's degree to get certified by the Institute of Management Accountants (IMA). When you complete and pass the exam, you can begin with extra training and courses to better your chances of landing a job.

There's a projected job growth of 6% from 2021 to 2031 for this job that pays a median annual wage of $77,250.

15. Loan officer: $63,380 per year

In this job, you will be overseeing the loan processor and approving loan applications that they pass on to you. They will give you recommendations based on the research they conducted about the clients.

You need a bachelor's degree and some training provided by the company you choose to work at. If you want to become a mortgage loan officer, you will need a Mortgage Loan Originator (MLO) license.

The outlook for this job, which pays a median annual wage of $63,380, is positive. From 2021 to 2031, there's a projected job growth of 4%.

16. Branch manager: $63,931 per year

The thousands of major bank branches across the country need a branch manager to oversee all their operations. You will be making decisions, hiring new staff members, and approving marketing strategies.

You need a bachelor's degree, but a master's will put you a step ahead of fellow job applicants. Reputable major banks will choose to hire the applicant with the most experience and highest qualifications.

As a branch manager, you will earn an average of $63,931 per year. What's more, with the constant expansion of banks, there is a projected growth of 18.7% from 2016 to 2026.

How many jobs are available in major banks?

As mentioned before, according to Statista, there are more than 1.95 million workers employed at the 4,237 FDIC-insured major banks in the US.

The future outlook for employment in all business and financial jobs is positive, with a projected growth of 7% from 2021 to 2031. That's an average of 715,100 jobs that will be opening in this timeframe.

Plus, you can get ready for 980,200 extra jobs opening every year in the same decade. These openings are due to employees stepping out of the job market or changing positions.

The BLS projects the median wage for business and financial positions at $76,570 per year.

Conclusion

Despite the weary answer to the question of how many jobs are available in major banks, it's still worth it to pursue a career in the industry. With an overall growth of 7% for the business and financial industry, the chances of getting a job aren’t too slim.

Most jobs in banks pay well and include many benefits while the hours are reasonable. The minimum requirement for most positions is a bachelor's degree, which is manageable to obtain.

Entry-level jobs offer an opportunity to grow and work yourself up to a better bank position, so don't lose hope if you struggle to land a top-tier job at first.

Written by

I am the CEO and founder of Overmentality. I am a professional business and technical blogs writer and on-page SEO specialist. I hold a degree in Culture Studies and Media Literacy from the English Humanities and Art Department. And I am interested in Digital Marketing, Business, Entrepreneurship, Leadership, and pets of course!

You can reach me via email here: hamiidnouasria@gmail.com

Or find me on my LinkedIn Profile.