Real estate investment trusts, or REITs, have undergone significant growth during the past few decades.

The market capitalization of REITs went through an increase from $389 billion in 2000 to over $1.1 trillion in 2017 in the United States alone, and most REIT categories went up substantially in 2021, rebounding quite well from the pandemic.

This seems like a promising industry, so you see this, and you might wonder, “How many jobs are available in real estate investment trusts?”

If you’re reading this, the chances are high that you are looking for opportunities in REITs, which means that this rapid growth is good news for you.

Current and potential investors, and even everyday people looking for jobs in this particular sector, can tap into this booming industry. But to do that, you need to know what you’re getting into.

You need to know what exact opportunities are available for you to take advantage of. If this is you, and what you’re looking for, you’re in the right place.

What are REITs?

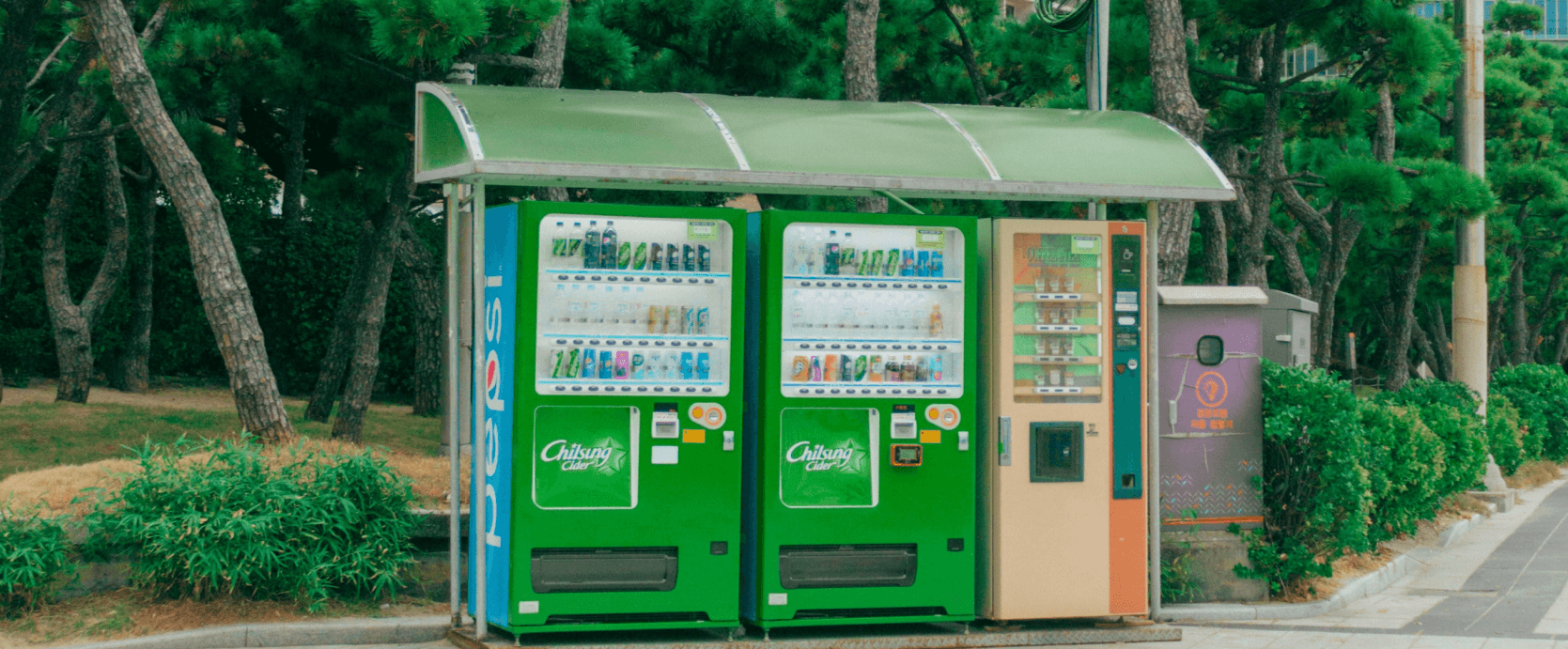

Real estate investment trusts (REITs) are companies that own, operate, and/or financially support properties that produce income. From hotels and shopping centers to apartment buildings and warehouses, REITs oversee a wide variety of real estate property types across various sectors.

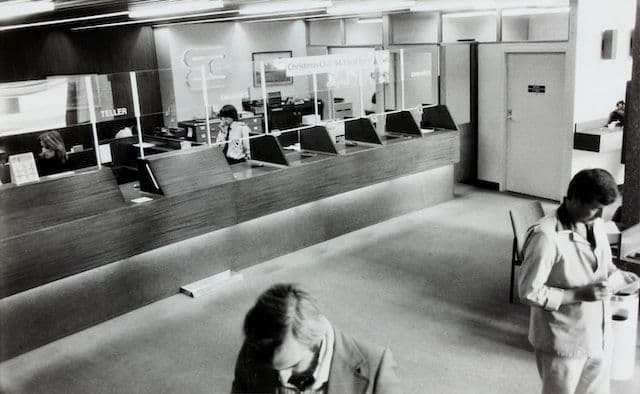

Created as a means of providing the average American with opportunities to invest in and benefit from income-producing properties. REITs came into existence when President Dwight D. Eisenhower signed Public Law 86-779 (also known as the Cigar Excise Tax Extension of 1960).

REITs operate on a simple and straightforward business model: They lease space and collect the rent on the properties, which they then give to their shareholders as dividends.

From an investment standpoint, they essentially work like mutual funds, making real estate assets available to anyone who wishes to invest in them. Similarly, you can invest in any other industry.

How do REITs function?

So, we know what REITs are, but how do they work?

Well, let’s take an example. Say, Crown Castle International, a REIT operating and headquartered in the United States. Basically, it works like this:

After Crown Castle qualifies as a REIT, investors can buy the company’s shares, which, because REITs are modeled after mutual funds, entitles each investor to partial ownership of all of Crown Castle's investments.

Then Crown Castle pools all this money from all these different shareholders and invests in a variety of real estate property investments. This investment might be through direct ownership of these properties, collection of real estate loans, or both.

Crown Castle will then make income from these properties either through rental payments from tenants or from the collection of loan interest payments. The trust will then use this income to pay its investors according to their initial investment in the form of dividends.

The jobs available in real estate investment trusts (Rs of REITs) are:

REITs are responsible for every stage and aspect of any real estate project they oversee, so this means that there are many different types of available jobs in REITs, with varying positions, levels and roles.

Between the agents, project managers, and the professionals who manage the trust’s assets, there are dozens of potential purposes you could fulfill when working in REITs.

Development Roles

This aspect of the job is all about developing new projects, as well as working out the finance for those new projects. This particular role is suitable for anyone looking for managerial opportunities in this sector.

Acquisition Roles

Acquisition roles involve seeking new investment opportunities for the company. They oversee investment deals and work to ensure that they are successfully closed. These roles are heavily based on finance, so this is a good opportunity for job seekers with a finance background.

Property Management Roles

Property managers are in charge of the operations of a given property. Everything from leasing to maintenance occurs under the supervision of the property managers. These roles are a good opportunity for anyone with general managerial skills.

Asset Management Roles

The asset management roles are responsible for making sure the company’s investment portfolio is intact. Asset managers develop and maintain the assets of the company’s clients, by making sure that the investments are in line with the clients’ investment goals and preferences.

Asset managers need to be collaborative, as their work tends to intersect with colleagues from other departments, such as acquisitions, finance, and accounting amongst others. They are also required to operate in compliance with industry regulators.

Investor Relationship Roles

These roles are responsible for communications between the company and its shareholders. Apart from managing communications, they also manage annual meetings and meeting documents. These roles are good for anyone with a finance or accounting background.

Why are REITs a great investment?

Investing as a whole will always come with risk in one degree or another. However, investing in REITs tends to come with more pros than cons, mainly because of the following reasons:

Relatively low risk

Although it is impossible for investing of any kind to be completely risk-free, REITs are a good investment to make because of the low risk that comes with this particular model, especially compared to most other forms of investment.

Straightforward business model

REITs are a great investment choice for many reasons, but one of the most fundamental of those reasons is that they are simple, straightforward, and easy for anyone to understand.

Investing can be a difficult concept to wrap your head around mostly. So, knowing exactly what you’re putting your money into gives you the power of deciding exactly where your money goes.

Stable and substantial yields

Real estate investment trusts are reliable for investment because they provide substantial income that tends to stay quite stable through a variety of wider economic and financial conditions.

Long-term competitive returns

REITs have a stellar track record of delivering returns that are competitive not only with those of higher stocks but even more than those with more fixed-income investments.

Because REIT management teams focus on maximizing shareholder value, not only do they work to ensure that their properties attract and retain stable tenants, but they also buy and sell properties strategically so they can build value over the long term.

Ideal for small investors

REITs are good for small investors for a number of reasons. One is that because it involves a pool of many investors, it opens up the possibility of owning real estate for people who would otherwise not be able to afford these opportunities.

They are also a good investment choice for retirees and people looking to save for retirement because they can provide a constant supply of income that can last a lifetime.

Transparency

Because REITs are usually monitored by independent auditors and analysts, there is more transparency in how they operate than in sectors where this may not be present. This means that you are protected as an investor, making it a very good choice for your investments.

Diversification

As a business model, REITs tend to operate on multiple properties. This means that not only are investors able to diversify their portfolios, but their investments are also better protected than they would be by relying on one single property. This makes REITs a low-risk business model.

Liquidity

Because it’s quite easy to buy and sell real estate investments, investing in REITs also means you get the advantage of liquidity, which means that, as an investor, you can easily turn your assets into cash.

REITs aren’t great for big investors only!

Now, as advantageous as REITs are for investors, they aren’t the only ones who can benefit from what REITs have to offer. Working for a REIT can also provide great job and career opportunities.

About 274,000 people were employed in jobs in real estate investment trusts in 2019 alone, with another 2.6 million gaining employment indirectly through the REIT industry.

With the real estate market size growing to $10.5 trillion in 2020– almost twice the size it was ten years prior – despite the COVID-19 pandemic bringing unprecedented challenges, the residential real estate market is expected to grow by more than 9% in the next five years globally, growing industries mean an ever-increasing number of job opportunities. With this, it is quite obvious that building a career in real estate investment is definitely worth considering.

Conclusion

The real estate industry is incredibly fruitful, as it continues to grow over the weeks, months, and years. You can take full advantage of that growth not just by investing, but also by building a career in real estate investment.

Doing this requires time, patience, and hard work building the experience and the skills used in this specific industry, but educating yourself on what opportunities are available, and what you need to reach your career goals is a powerful first step.

Written by

I am the CEO and founder of Overmentality. I am a professional business and technical blogs writer and on-page SEO specialist. I hold a degree in Culture Studies and Media Literacy from the English Humanities and Art Department. And I am interested in Digital Marketing, Business, Entrepreneurship, Leadership, and pets of course!

You can reach me via email here: hamiidnouasria@gmail.com

Or find me on my LinkedIn Profile.