- How many jobs are available in the property-casualty insurers industry?

- 16 best jobs in the property-casualty insurers industry

- 1. Insurance agent: $56,331 per year

- 2. Insurance broker: $94,006 per year

- 3. Insurance sales agent: $49,840 per year

- 4. Claims adjuster: $65,080 per year

- 5. Underwriter: $76,390 per year

- 6. Insurance specialist: $48,388 per year.

- 7. Claims processor: $42,895 per year

- 8. Risk manager: $116,072 per year

- 9. Property claims adjuster: $61,000 per year

- 10. Actuarial associate: $115,000 per year

- 11. Customer service representative: $57,619 per year

- 12. Insurance appraiser

- 13. Condo insurance agent

- 14. Homeowners insurance agent: $88,637 per year

- 15. Landlord insurance agent:

- 16. Car insurance agent: $47,611 per year

- Eligibility requirements for a career in the property-casualty insurers industry

- Conclusion

We recently noticed an increase in questions about "How many jobs are available in property-casualty insurers?" and "Is property casualty insurers a good career path?"

We wondered what the sudden uproar was all about and decided to investigate.

It's no secret that the property casualty insurance field is very significant in the US. Individual households and businesses rely on their insurance companies to have their backs when things go south, which is completely understandable if you consider the fact that they pay lofty premiums every month.

With top companies like State Farm Group and Berkshire Hathaway Ins., it's completely expected that the gross premiums in this industry amounted to $797,7 billion in 2021.

However, it's not the size of the industry that we are interested in. We want to know if the industry holds a future for regular individuals and what the best-paying jobs in property-casualty insurers are.

In this article, we'll share everything that we could find about property and casualty insurer careers with you!

How many jobs are available in the property-casualty insurers industry?

According to the United States Bureau of Labor Statistics (BLS), there are 2,919,500 workers employed in insurance carriers and related activities.

It's important to note that not all of these employees are in the field of property and casualty insurance. Statista estimates that the number of property casualty insurers is closer to 628,600.

This is still an impressive figure, considering that this industry employs more workers than the telecommunications industry.

That's not the end of the good news regarding the property casualty insurers industry. We found out that there is a projected growth of 6% for insurance agents from 2021 to 2031. This may not be the entirety of the industry, but it gives us a good idea of where the rest of the jobs are heading.

16 best jobs in the property-casualty insurers industry

1. Insurance agent: $56,331 per year

As an insurance agent, your job will be to help insurance companies get new customers. You'll do this by selling policies and contacting potential clients to sell them to.

To become an insurance agent, you need a high school diploma. It's not a requirement to hold a bachelor's or associate's degree but it can increase your chances of landing a job at a reputable company.

You also need to become licensed to sell insurance policies. The process of getting a license includes pre-licensing hours and a final exam. You need to obtain a license for each type of insurance that you will be selling.

There is a growth of 10% expected from 2018 to 2028. These professionals earn an average of $56,331 per year.

2. Insurance broker: $94,006 per year

As an insurance broker, your job description will include selling insurance. You will be selling insurance policies and plans to potential customers and up-sell to existing customers.

To become an insurance broker, you need a bachelor's degree in any related field, which can be accounting, business management, or finance. Additionally, most employers prefer that you have proven work experience in the field.

The future of insurance broker jobs is bright, with a projected growth of 10% from 2018 to 2028. These professionals earn an average salary of $94,006 per year.

3. Insurance sales agent: $49,840 per year

As an insurance sales agent, you will be selling insurance just like insurance agents and brokers, but you will be creating your own customer base. You will also be required to explain the different policies to customers to help them find the best option.

Property-casualty insurance agents sell policies to people and businesses, in particular, to protect their property from damages, like fire, weather, and theft.

To become an insurance sales agent, you need to have a high school diploma. Obtaining a bachelor's degree will increase your chances of getting hired but it isn't a set requirement. Plus, you need to be licensed to work as an insurance sales agent in your state.

The BLS projects a growth of 6% for this job, resulting in 32,900 new jobs opening from 2021 to 2031. Insurance sales agents earn an average of $49,840 per year.

4. Claims adjuster: $65,080 per year

Claims adjusters fall into a larger category of claims adjusters, appraisers, examiners, and investigators. As a professional in this field, you will be inspecting the damaged premises or properties to determine the damage or loss.

You will also use other pieces of information, like evidence and statements, to create a report for the claims examiner. They will use your report to decide whether a claim should be paid out.

You need a high school diploma to become a claims adjuster but to get a better position at a reputable company, a bachelor's degree is recommended. You also need some insurance-related work experience to learn everything you need to know about the industry.

Unfortunately, there is a projected job decrease of 6% from 2021 to 2031, which will result in 19,000 fewer jobs by the end of the decade. Nevertheless, these professionals are still well-paid, with an annual average salary of $65,080.

5. Underwriter: $76,390 per year

As an insurance underwriter, your duties will include determining the risk of insuring potential clients. You will also need to thoroughly screen insurance applicants by following up on the information on their applications.

You will need to contact their references and use software to review their recommendations. With the information that you find, you will be determining their premiums and coverage amounts. You may also choose to reject their applications.

A high school diploma will be sufficient to land an entry-level position. However, most employers would prefer that you have a bachelor's degree or associate's degree in accounting or finance. It's a bonus if you have proven work experience in an insurance-related position.

Unfortunately, as with most other jobs in the property casualty insurers industry, this job is facing a 4% decrease from 2021 to 2031. In numbers, this amounts to 5,500 fewer jobs by the end of the decade.

Insurance underwriters earn an average annual salary of $76,390.

6. Insurance specialist: $48,388 per year.

As an insurance specialist, you need a comprehensive understanding of insurance and risk management. You will need to use your knowledge to assess claims and provide advice to customers.

You will build your own client base, whose accounts you will manage. You may also work in the legal field of insurance, which means that you'll have the job of ensuring that insurance companies comply with all the laws and regulations.

There is no set requirement that you need to become an insurance specialist. As long as you have the necessary knowledge and understanding of the industry, you can walk into a job with anything from a high school diploma to a master's degree.

Fortunately, this job is facing a 5% growth from 2018 to 2028. There will be 72,100 more jobs by the end of the decade. If you manage to land one of them, you could be looking at an average annual salary of $48,388.

7. Claims processor: $42,895 per year

As a claims processor or claims clerk, you will have the job of reviewing claim submissions and verifying the details. You will also be the contact person that corresponds with beneficiaries.

Once a claim is approved, you will be responsible for processing the claim and preparing the documentation. For this job, you only need a high school diploma and proven work experience in the insurance industry.

This job is facing negative growth from 2021 to 2031, with 6% fewer jobs by the end of the decade. The 19,000 job losses apply to the entire broad category of claims adjusters, appraisers, examiners, and investigators.

Claims processors earn an average salary of $42,895 per year. This number can increase significantly if you obtain a bachelor's degree.

8. Risk manager: $116,072 per year

As a risk manager, you will be explaining the risks of property and casualty insurance to clients and organizations. You need a thorough knowledge and understanding of the industry to be able to convey the right message.

To become a risk manager, you will need a bachelor's degree in business or finance and at least 6 years of proven work experience in a related field.

There will be a need for risk managers in the future because the job is facing a projected 16% growth from 2018 to 2028.

With the strict requirements to become a risk manager, it's only fair that risk management is one of the best-paying jobs in property casualty insurers. These professionals earn a six-figure salary, averaging $116,072 per year

9. Property claims adjuster: $61,000 per year

As a property claims adjuster, your job duties will include visiting the premises when an insurance claim is made. You will need to conduct interviews with witnesses and assess the amount of damage.

In the end, your responsibility will be to create a report that stipulates the final amount that needs to be paid out. You may also need to assist the legal team when an applicant contests a claim.

To become a professional in this field, you need a high school diploma. However, this will only get you into an entry-level position. If you're aiming for something higher, you would need a bachelor's degree in finance or business.

Unfortunately, the number of jobs in this field is facing a decline of 4% from 2018 to 2028. Property claims adjusters that manage to make it into the field earn an average salary of $61,000 per year.

10. Actuarial associate: $115,000 per year

As an actuarial associate, you will be giving the CEO of a company advice on insurance policies. They will consult with you to help them make the best choices that will protect their assets and property at the end of the day.

To become an actuarial associate, you need to have a solid understanding of insurance, statistics, and computing software. With this, you also need a bachelor's degree in a related field and at least 2 years of proven work experience. Once you land a job, you will need to further your education with seminars and examinations.

There is big growth expected for this job, with a 20% increase from 2018 to 2028.

Actuarial associates are some of the highest-paid professionals in the property-casualty insurance industry, with an average annual salary of no less than $115,000.

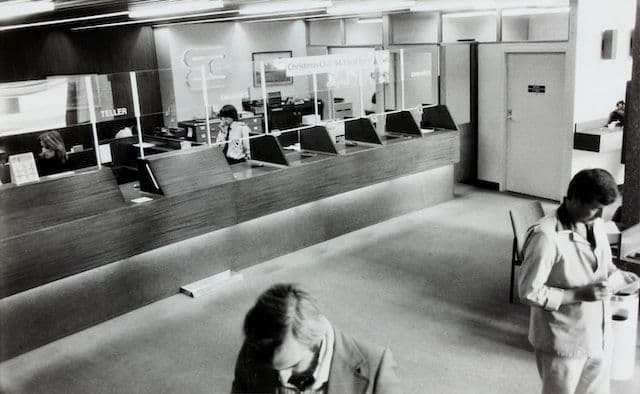

11. Customer service representative: $57,619 per year

As a customer service representative in the property-casualty insurers industry, you will be working with insurance company customers. You'll be required to answer their queries and direct them to the right department when they are facing problems.

You need to handle customer complaints and take orders and payments. Your job will also include keeping a record of all your correspondence with customers and stakeholders of the company.

Needless to say, you should know how to work with a telephone and all the necessary software that you'll be using in this job. Most employers offer on-the-job training so you can start working with just a high school diploma.

There are more than 2.8 million customer service representatives in the US. This number includes employees in all customer service fields and not just those that work in property-casualty insurance.

Unfortunately, this number will be decreasing by 4% from 2021 to 2031, resulting in a loss of 105,300 jobs.

The salary that you can expect varies according to the industry that you choose to work in. However, the overall average salary of customer service representatives in the US is $57,619 per year.

12. Insurance appraiser

As an insurance appraiser, your daily duties will include working with other professionals in the insurance industry.

You'll need to assist these professionals by inspecting the damages after a loss has occurred and a claim has been made. Your job will be to create a report of the cost calculations, which you will then need to forward to the insurance adjuster.

To land an insurance appraiser job, you need a high school diploma at minimum. A bachelor's or associate's degree will increase your chances of landing a high-paying job but it isn't a set requirement.

Unfortunately, there is a decline of 4% expected for this job from 2018 to 2028. Nevertheless, professionals in this job still make an average salary of $53,229 per year.n

13. Condo insurance agent

As a condo insurance agent, you will sell insurance to individuals that want to cover their condominium units, or condos, against theft, weather damage, and fires.

Since this job is a branch of the insurance agent profession, the job description is very much the same, except for the fact that you'll be focusing on condos specifically.

You'll need a license to sell insurance and a high school diploma to land a job that could pay an average of $56,331 per year, which is the average salary for all types of insurance agents.

The entire insurance agent profession is looking at a growth of 10% from 2018 to 2028.

14. Homeowners insurance agent: $88,637 per year

Homeowners insurance is for property owners who want to cover their homes. Working as an agent in this field, you will sell insurance to these individuals to cover their properties against weather, fire, or theft.

You'll need a license to sell homeowners insurance in your state and a high school diploma. If you want to land a higher position, obtaining a bachelor's degree is a good choice.

Just like other types of insurance agents, this type is facing a growth of 10% over the decade spanning from 2018 to 2028.

Homeowners' insurance agents earn an average of $88,637 per year.

15. Landlord insurance agent:

While homeowners insurance agents sell insurance to homeowners, insurance for landlords works slightly differently. Homeowners typically reside in their property, while landlords get insurance from these professionals to cover the properties that they rent out.

As a landlord insurance agent, your duties won't differ much from those of insurance agents in other fields. However, your license to sell insurance needs to be in the landlord insurance field.

Since the entire insurance agent profession is facing a 10% growth from 2018 to 2028, it's safe to say that this job is heading in the same direction.

Landlord insurance agents in the US get paid the same average amount as most types of insurance agents, which is $56,331 per year.

16. Car insurance agent: $47,611 per year

Car insurance agents, or auto insurance agents, are insurance agents that specialize in insurance for automobiles and vehicles. As a professional in this field, you'll take care of regular insurance agent duties, while specifically focusing on car insurance.

You need a high school diploma or a bachelor's degree if you want to take your career further. Plus, you'll need to have a car insurance license to be able to sell insurance in your state.

Car insurance agents are expected to grow with the other types of insurance agents, which is expected to be 10% from 2018 to 2028.

These professionals earn an average of $47,611 per year.

Eligibility requirements for a career in the property-casualty insurers industry

There are many different jobs in the industry, but to land one of them, you need to know the minimum requirements. There isn't a set guideline that every employer follows, which means that the requirements can differ between jobs and employers.

Nevertheless, if you want to increase your chances of getting hired as a property casualty insurer, you can start by obtaining the following:

High school diploma

Many jobs require no more than a high school diploma. This is very beneficial because you can walk into a job straight after school and start working yourself up toward your preferred position.

Bachelor's or associate's degree

While a high school diploma gets you into an entry-level job, some employers won't consider hiring you if you don't hold a diploma in any related field. Business, finance, and economics are the typical fields that'll put you a step ahead of other applicants.

Licensing

You will need a license to sell insurance. To become a licensed insurance worker, you will need to complete classroom hours and training before passing a final exam. The license that you need depends on the state where you live.

Conclusion

The question of how many jobs are available in property-casualty insurers has now been answered.

From this point onward, it's up to you to decide whether you want to take your chances with the 6% growth of this industry or choose another industry to work in.

Selling insurance and working with claims isn't for everyone, so you need to be certain that the jobs in this industry are something that you'd like to pursue.

No matter what you decide, we're sure that you'll be able to make a success of your career path!

Written by

I am the CEO and founder of Overmentality. I am a professional business and technical blogs writer and on-page SEO specialist. I hold a degree in Culture Studies and Media Literacy from the English Humanities and Art Department. And I am interested in Digital Marketing, Business, Entrepreneurship, Leadership, and pets of course!

You can reach me via email here: hamiidnouasria@gmail.com

Or find me on my LinkedIn Profile.