- What is investment management?

- Which jobs are available in the investment managers industry?

- 1. Portfolio assistant: $106,690 per year

- 2. Investment bankers: $85,150 per year

- 3. Financial analyst: $91,580 per year

- 4. Financial traders: $89,618 per year

- 5. Financial manager: $131,710 per year

- 6. Financial advisor: $94,170 per year

- 7. Credit analyst: $77,440 per year

- 8. Wealth manager: $107,000 per year

- 9. Equity trader: $86,617 per year

- 10. Portfolio manager: $86,246 per year

- 11. Investment banking analyst: $91,580 per year

- How many jobs are available in investment managers?

- 5 reasons why investment management is a good career

- Conclusion

Investment management is a great career path for anyone interested in numbers, money, and finances in general.

If you have great mathematical and analytical skills and the desire to help people make money, a career in investment management is certainly something to consider.

There are many firms that hire workers in this industry. However, most job types allow you to become your own boss and start your own firm.

The United States has a number of large asset management firms, like BlackRock Inc, which currently has $8,594 billion in assets under management and 20,000 people in employment.

So, if a single company can employ thousands of workers, how many jobs are available in investment managers as an industry?

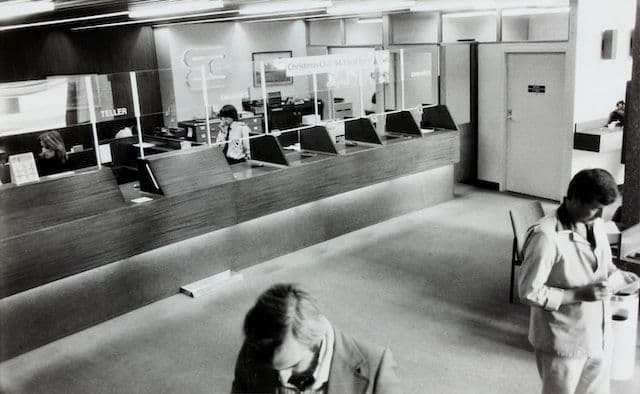

Investment managers are a type of financial manager. The United States Bureau of Labor Statistics estimates that there are more than 730,000 financial manager jobs available as of 2021.

What is investment management?

Contrary to popular belief, investment management isn't limited to the buying and selling of stocks and investments. It refers to the entire process of getting these stocks, from analyzing the markets and formulating strategies to negotiating prices.

It includes the long- and short-term planning that goes into obtaining the best investments with minimal risk. The manner in which assets and funds are managed is also a part of investment management.

Which jobs are available in the investment managers industry?

The investment managers industry may sound like a fairly limited career path. Truth is, you would be surprised to learn exactly how many different types of jobs are available in the industry.

With the help of the US Bureau of Labor Statistics, we found the average investment manager's salary and job outlook for 11 different jobs.

1. Portfolio assistant: $106,690 per year

Portfolio assistants have the job of assisting the portfolio manager with their general duties. You'll be required to meet with all staff members and report back to the portfolio manager with information on any issues.

As a portfolio assistant, you ought to make the portfolio manager's job easier, so you need a bachelor's degree and at least 6 years of experience in the field.

To gain the required years of experience, you can work as an assistant in other financial positions. In addition, several skills like communication and analytical skills can also help them in their daily tasks.

There's usually 3 months' worth of on-the-job training involved before you can expect to earn $106,690 per year.

According to Zippia, the outlook is very positive for this job. With a 16% growth between 2018 and 2028, the 104,700 jobs are sure to open new worlds for many individuals.

2. Investment bankers: $85,150 per year

In short, working as an investment banker, you'll be a middleman between a company and investors. You'll have a very sensitive job, for which you need to have a bachelor's or master's degree. In some cases, the minimum requirement may even be a doctorate.

As a professional in this job, you'll work with the finances of investors, governments, and businesses. You'll need to assist companies and businesses in obtaining loans and managing investments while keeping an eye on the investment climate.

As an investment banker, you can earn an annual average of $85,150 per year. This amount depends on your previous years of experience and the degree that you hold.

You also need to be registered with the Financial Industry Regulatory Authority (FINRA), which requires training and passing an exam.

Investment bankers fall into a larger category, known as securities, commodities, and financial services sales agents. The job outlook for all workers in this category is positive, with an expected growth of 10% from 2021 to 2031. In numbers, that adds up to 47,700 new job opportunities.

3. Financial analyst: $91,580 per year

Financial analysts work with all aspects of a company's finances. Your duties will include setting up portfolios, studying the markets and trends, conducting appraisals and valuations, and creating financial reports.

There are two types of financial analysts, namely:

- Buy-side analysts: They come up with strategies for companies to invest their money. These companies can be private equity firms, insurance companies, or non-profit organizations.

- Sell-side analysts: They are on the other end of investments because they help the agents who sell stocks and investments.

In both cases, you need to have a bachelor's degree in a related field. In addition to a degree, analytical, computer, communication, decision-making, and mathematical skills are very important.

Meeting these requirements can help you earn a median annual wage of $91,580 as a financial analyst. However, you could also earn a commission, depending on your employment conditions.

Fortunately for all future analysts, there will be 31,900 jobs opening from 2021 to 2031. That's a 9% growth!

4. Financial traders: $89,618 per year

Financial traders buy and sell shares, assets, and bonds. You can do this on behalf of individuals, companies, and financial institutions. You will have the job of ensuring that there is minimal risk and maximum assets.

To become a financial trader, you need a bachelor's degree in any related field. Being registered with the Financial Industry Regulatory Authority is also mandatory.

If you add a few years of trading experience, you can expect to earn an average of $89,618 per year.

Financial traders fall into a larger category of securities, commodities, and financial services sales agents. For this category as a whole, the future holds a growth of 10% more jobs from 2021 to 2031.

5. Financial manager: $131,710 per year

Financial managers have a number of financial duties. As a worker in this field, you'll have the job of preparing statements and reports, overseeing the duties of employees, and advising management when it comes to financial decisions.

A bachelor's degree is a typical minimum requirement for this job. Any less than 5 years of experience and a lack of analytical skills won't cut it when applying for a financial manager position.

There is an expected growth of 17% from 2021 to 2031. New and existing workers earn a median annual wage of $131,710. However, factors like experience and qualifications can affect your final salary.

6. Financial advisor: $94,170 per year

Financial advisors can work for individuals or companies. You also have the option of working for a company or starting your own firm and doing private consultations.

You'll be responsible for advising your clients when it comes to their taxes, retirement funds, insurance, mortgages, investments, and savings.

In some cases, a bachelor's degree is a sufficient qualification. However, a master's degree is always a plus. Additionally, being certified with the Certified Financial Planner Board of Standards can dramatically improve your chances of landing a job at a large firm.

Financial advisor jobs, which have a median annual salary of $94,170, are projected to grow by 15% from 2021 to 2031.

7. Credit analyst: $77,440 per year

Credit analysts work for financial institutions that provide credit. You'll need to analyze the financial past of new applications and advise the institution on their creditworthiness. In other words, your job will be to help them decide whether the client's credit application should be approved or rejected.

You'll need at least 2 years of experience after obtaining your bachelor's degree if you want to become a credit analyst. Working as a cashier or administrative assistant is usually a good way to gain experience.

An additional 1-3 months of on-the-job training is required before you can expect to earn an average of $77,440 per year.

Zippia projects a 4% decrease in the number of credit analyst jobs from 2018 to 2028.

8. Wealth manager: $107,000 per year

Wealth managers work with clients to help them manage their finances. You'll be hired to advise them on tax issues, estate planning, retirement funds, and investments.

To become a wealth manager, you need a bachelor's degree in any related field. Additionally, you need a certification from the Financial Industry Regulatory Authority (FINRA).

Wealth managers typically act as personal financial advisors, for which a 15% employment growth is projected from 2021 to 2031. Individuals in this job earn no less than an average of $107,000 per year.

9. Equity trader: $86,617 per year

Equity traders have a long list of daily tasks. These tasks include buying and selling shares, analyzing the risks, and finding ways to trade on behalf of your clients. You need to keep a close eye on the markets and find the perfect time to buy into different shares and stocks.

Your main objective as an equity trader is to make the maximum amount of profit for your clients. To be able to do this, you need a bachelor's degree and a minimum of 5 years of proven working experience. Being registered with FINRA is optional, but beneficial.

If you want to start a career in this profession, you can apply for one of the new jobs that will be opening from 2021 to 2031. A growth of 4% is expected, so there should be a space for you.

If you take a chance and apply, you could earn an average salary of $86,617 per year. Many workers in this field work for a commission that can add up to an extra amount of more than $25,000.

10. Portfolio manager: $86,246 per year

Portfolio managers take complete control of a client's portfolio. You'll need to manage their finances and make investments to generate interest, securities, and returns.

You need to know how financial markets work and be able to find the best ways to analyze market trends. In addition to this, you need a bachelor's degree and four years of experience. If you are credited as a chartered financial analyst by the CFA Institute, your chances of landing a job are doubled.

It's important that you register with the U.S. Securities and Exchange Commission (SEC). Especially if you intend on managing any portfolios with assets worth more than $25 million.

Portfolio and other financial managers are expecting a joint growth of 17% from 2021 to 2031.. These professionals earn an average of $86,246 per year, excluding commission.

11. Investment banking analyst: $91,580 per year

Investment banking analysts work for financial institutions and businesses. You can also work for individuals, for whom you will assess markets, portfolios, and financial data.

You need to have a vast knowledge of hedge funds, venture capital, investments, and assets because you'll be the person who gets called by clients for information.

A bachelor's degree could bring you a median annual wage of $91,580 but a master's degree gives you the potential of earning a six-figure salary.

Financial and investment analysts are facing a 9% growth from 2021 to 2031.

How many jobs are available in investment managers?

To get the exact data on investment management in the US, we had to look into the financial management industry that it forms a part of.

According to the Bureau of Labor Statistics, there were 730,800 financial manager jobs in 2021.

The number is expected to grow by 17% over the next year, resulting in 123,100 new jobs. In 2031, the number of financial manager jobs in the US will be 854,000.

5 reasons why investment management is a good career

There are many reasons why becoming an investment manager is a good choice. Especially if you have a love for numbers and helping people make good choices when it comes to their money.

Here are 5 of the best reasons why you should consider starting a career in investment management:

1. There are many career options in investment management

There's no such thing as a single investment manager job description. Not all job types in this industry have the same salary, duties, or outlook.

In the investment management industry, you can become anything from a credit analyst to a portfolio manager.

2. You can make a six-figure salary

There's not much to say about this reason to become an investment manager. Nobody can say that they wouldn't enjoy earning six figures, and you have the opportunity to be someone who does!

Most jobs in this field have an average salary of more than $100,000. In some cases, the average salary falls just below six figures, but you can always increase your salary by improving your qualifications.

3. There's never a dull moment in investment management

The work of an investment manager is never done. Plus, you'll never be bored because this job requires you to keep up with trends and market shifts. You will be managing enormous amounts of money, and the risk brings on the adrenaline rush.

You need to be able to think on your feet when there's a disaster threatening to happen. Plus, the markets are constantly changing so you need to act fast if your client's life savings are at risk.

4. You can work on your own terms

As an investment manager, you won't be restricted when it comes to the way that you do your job. There are many employment options available that will allow you to do your own thing.

You can start your own business as a worker in this industry instead of working for a firm. You also have the option to work anywhere in your country, or even abroad.

Your salary depends on what's written in your employment contract but you can make extra by charging a commission. Plus, if you are your own boss, you can determine your own fees. Not to mention that you can choose your own working hours because investment management isn't a typical nine-to-five.

In addition to all these decisions that you can make on your own terms, you have the opportunity to start your career whenever you want. Since most jobs only require a bachelor's degree, you can walk straight into a job after obtaining your qualification.

5. It's a way to help others

There's a warm feeling that comes with helping someone grow their finances and enabling them to retire early. It's a sense of achievement or accomplishment that you'll rarely experience with other jobs.

If helping others is your passion but the medical field isn't for you, investment management is the way to go. You get to do your dream job while living out your passion. It's a win-win!

Conclusion

Due to unforeseen events, like workers changing their career paths, getting promoted, or retiring from the workforce, the number of jobs in all industries are constantly changing.

There could be new jobs today, or perhaps fewer than yesterday. Now that you know how many jobs are available in investment managers, we certainly recommend applying for your dream job.

If you don't get it, you can always work your way up by gaining experience. This can be done with part-time jobs and entry-level positions that'll grant you the opportunity to grow.

Improving your qualifications can also put you one step ahead of your competitors.

Written by

I am the CEO and founder of Overmentality. I am a professional business and technical blogs writer and on-page SEO specialist. I hold a degree in Culture Studies and Media Literacy from the English Humanities and Art Department. And I am interested in Digital Marketing, Business, Entrepreneurship, Leadership, and pets of course!

You can reach me via email here: hamiidnouasria@gmail.com

Or find me on my LinkedIn Profile.